Image credit: BI India

Since the start of the year, the cryptocurrency market has been in the red, but the market for non-fungible tokens (NFTs) has been prospering – at least on paper. According to data compiled by The Block Research, NFT trade volume increased nearly thrice in January, from $2.67 billion in December to $6.86 billion in January.

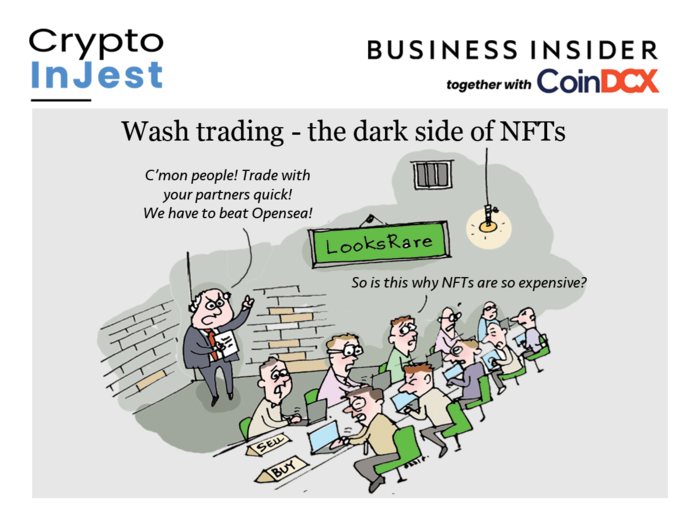

The majority of the credit for the increase goes to LooksRare, a new NFT platform that is being marketed as a “decentralised” alternative to OpenSea, the market leader in terms of all-time value. This isn’t to suggest that OpenSea didn’t had its share of success. In fact, it increased its trade worth by a factor of two.

While the reduction in the value of cryptocurrencies, particularly Ethereum, made NFTs more affordable, analysts believe that at least some of the increase is artificial. The massive trade value exhibited on LooksRare could just be the consequence of NFT owners buying and selling digital art amongst themselves to artificially inflate the price – a process known as ‘wash trading.’

The practice of wash trading is making a comeback.

Within the first 24 hours of coming live, LooksRare hauled in $100 million in NFT sales. Many suspected even back then that the huge trade volumes were a house of cards that would fall apart once the enthusiasm wore off.

LooksRare had the good fortune to start at a time when OpenSea was under criticism for allowing a bug to be exploited, allowing hackers to buy NFTs for less than their market worth.

However, the concept of ‘wash trading’ is not new. In 2017, the Securities and Exchange Board of India (SEBI) issued a regulation to combat wash trading, also known as self-trading. This follows the Ketan Parekh Scam, in which shell firms were utilised to trade the shares of ten low-profile stocks in order to artificially raise their price.

Where is the profit in wash trading with NFTs?

Wash trading is defined as when a seller buys their own goods to create false demand and manipulate the price of the commodity to increase higher than it would otherwise. Such behaviour distorts the market and is illegal in the majority of countries. However, because the crypto market is not as tightly controlled and monitored as the rest of the financial system, some people are able to get away with it.

At the end of January 2022, the NFT marketplace LooksRare reported trade volumes of $2.25 billion. The rapid increase in just twenty days, as well as their average trade volume per transaction of $415,000, is remarkable.

From the day LooksRare was introduced, Google Search Trends reveal a significant increase in interest in NFT from nations such as Russia, Turkey, and Ukraine.

Wash trading is even more appealing to traders who can carry it off because LooksRare is organised as a community-owned marketplace that distributes earnings with dealers. Wash trading would be unprofitable, according to the LooksRare marketplace documents, due to NFT royalty payments, trading platform expenses, and crypto gas fees. However, according to CoinTelegraph, a few large wash traders have found a way to avoid paying licencing fees by using NFTs.

The ‘wash traders’ profit from LooksRare’s ‘trading incentives,’ with the largest receiving the most LOOKS, the native coin utilised on LooksRare. They can then exchange their LOOKS tokens for Ether tokens, which can be utilised throughout the crypto world.

According to the data, these transactions on LooksRare, which account for only 2% to 3% of the deals on OpenSea, have managed to account for 50% of the total trading volume on OpenSea. In mid-February, LooksRare plans to decrease the trading reward it distributes to traders.

According to Delphi Digital such a model is unsustainable, and traders would depart when wash trading becomes unprofitable, resulting in a major decline in trading volume. Is it possible that trades would become more genuine after that, or will the halved rewards still encourage unsustainable behaviour?