The Canada-based startup Covalent offers billions of data points on assets across blockchain networks through a team of blockchain engineers, database analysts, and data scientists. Ganesh Swami, co-founder and CEO, explains how.

The path leading to the launch of blockchain data analytics and building the ‘Google of blockchain’ for Ganesh Swami, who began his career as a cancer researcher, was far from predictable.

After graduating from Simon Fraser University in engineering physics, Ganesh saw that pharma products took up to five years to reach the market, while tech products were built, funded, and liquidated within 18 months by his engineering peers.

As a result, Ganesh shifted to the Big Data sector – a move that led to the founding of Covalent in 2017, a Vancouver-based startup providing visibility to billions of blockchain data points through a unified API.

“Blockchain was an exciting new technology, but for it to achieve mainstream adoption, we realised it had to speak to and work in tandem with existing technology, processes and talent. There was a need for middleware connecting the blockchain world to existing infrastructure. This inspired us to launch Covalent,” says Ganesh.

The startup aims to bridge the world of centralized databases with the new world of distributed blockchain technologies to solve infrastructure challenges inhibiting blockchain adoption.

What is the Google of blockchain?

With the advent of Google’s indexing and compiling data across the Internet, the company has established itself as an industry leader. By using Covalent, Ganesh intends to index blockchains including data and information that is constantly added.

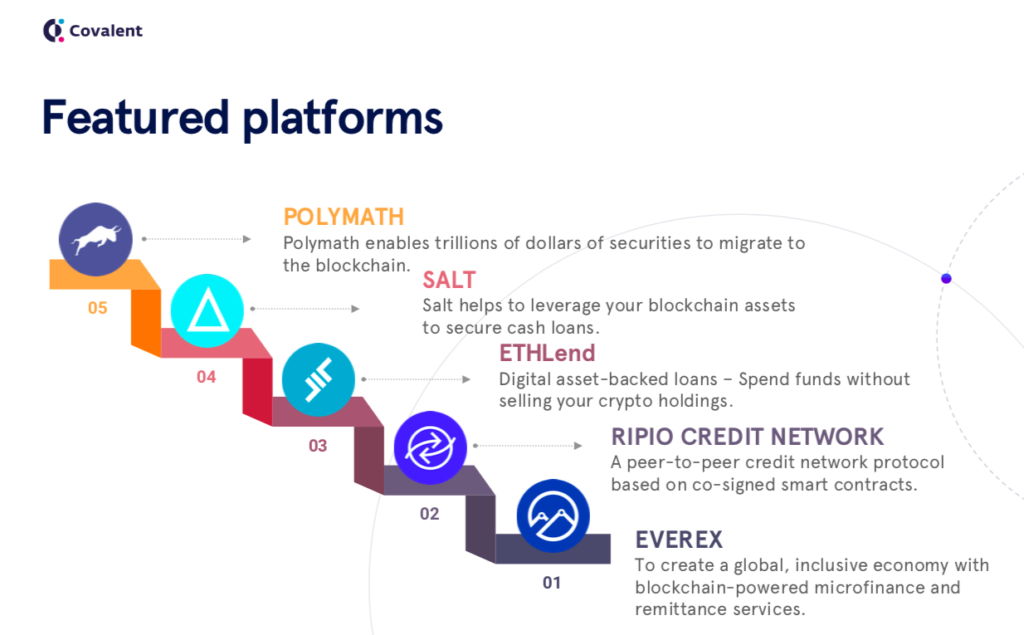

According to Ganesh, Covalent has used over 100 projects and indexed billions of blockchain transactions, including each transaction for over 12 blockchains, including Ethereum, Binance Smart Chain, Polygon, Polkadot, Elrond, Near, and many others.

“Although blockchain data is public, retrieving it in a reliable fashion is extremely difficult. Developers have to download terabytes of data and crunch the numbers just to answer simple user queries asking about their account balances. Further, the work has to be repeated across teams building financial products on blockchain,” he adds.

Covalent provides the solution to that problem.

The startup is solving this problem by empowering developers with its unified API enabling them to integrate the startup’s blockchain products and allowing users to see transaction history and account balances easily.

“There’s no UI or buttons you can click. Our solution is targeted at developers who can use our API at the click of a button and display it in whatever fashion they deem fit,” Ganesh says.

Revenue model based on supply

Developers were initially charged a fee for using the startup’s API based on the SaaS model.

In contrast, new developers aren’t paying customers of Covalent any more.

Two rounds of funding totaling $5.1 million were raised by the startup, and in 2020 it turned profitable. In 2021, it focused on monetizing companies that built top blockchains.

“The demand for our product came from developers and the supply came from the blockchain projects we index. But many blockchain developers and their startups may not have product-market fit and cannot themselves build a solution like ours. Since the opportunity was huge, we positioned ourselves to monetize the supply side, i.e. the blockchains now pay us for access to the developers,” Ganesh says.

A new decentralization network called Covalent will be launched by the startup later this year.

The decentralized network will allow supply (blockchain networks) and demand (developers) to transact directly with one another, allowing anyone to make use of it.

The development of Covalent

A remote computing hackathon spawned the development of Covalent’s first version in 2017. The service was later commercialized after Ganesh won the hackathon.

During that time, blockchain and crypto startups were experiencing a slowdown, and few customers found their way to the startup. After a period of stagnation from 2018 until 2019, the industry began to grow again as attention was paid to stablecoins, decentralized apps, and, later, NFTs.

“We were anxious for the first one-and-a-half years since we had almost no traction. We started seeing traction in 2019 and became profitable in 2020. This gave us a major sigh of relief as we were bootstrapped till then, and we becoming profitable meant we didn’t have to worry as much about our runway. That’s when we began focusing on building a sustainable product for the future and raised capital from outside,” Ganesh says.

Differentiating factors of Covalent

In a future cloud economy where blockchain technology becomes mainstream and fintech companies, such as Covalent, offer decentralised finance experiences, Covalent is building for mainstream adoption.

A startup such as this aims to provide fintech players with visibility on blockchain data points to provide account balances, historical activity, and transactions to their users through its API.

“There is definitely competition in the market, but our talent, product and community are our key differentiating factors,” Ganesh says, adding that while rivals can also build strong teams and products, the community cannot be copied.

“We are proud of our alchemist community programme – a growth and leadership initiative with over 2,000 community members who carry forward the Covalent message. We have allocated one percent of our equity to fund it,” he adds.

Decentralizing the future

With the advent of blockchain technology, Ganesh believes Covalent can follow the examples of Google and other search engine/indexing giants.

An era of blockchain innovation is beginning to unfold in India and around the world, Ganesh believes, Covalent has a role to play in ushering in an age of decentralized data access that is easier than ever before.

“Some countries remain skeptical about blockchain technology. Covalent can help bring transparency and visibility to financial transactions and address the problem. Mainstream adoption can be accelerated by large organizations in leadership positions taking blockchain products and pushing them, like how Jio went about bringing the Internet to the Indian masses,” Ganesh says.