Another of the notorious price swings that cryptocurrencies are renowned for got beginning amid reports that the Centre is planning to draught a Bill in Parliament to crack down on these unregulated assets in India, which has one of the world’s largest crypto-ownership bases. Even as the RBI has declared intentions to develop its own digital currency, the Centre has consistently expressed its reservations about cryptocurrencies. Here’s all you need to know about India’s crypto ecosystem.

In India, how many people own cryptocurrency?

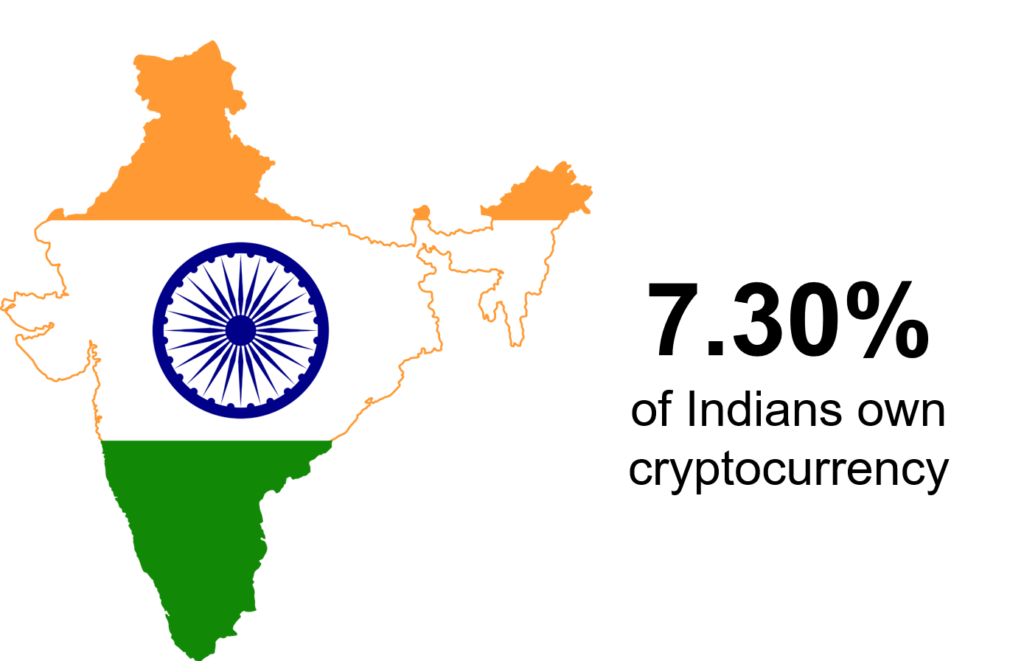

According to industry estimates, more than 10 crore Indians, largely young people but also older folks, have invested in cryptocurrencies. The country is projected to have approximately 10.07 crore cryptocurrency owners, putting it far ahead of the US in terms of overall holdings, however it is expected to outpace India in terms of total value.

CREBACO, a crypto research organisation, claims that overall cryptocurrency investments have risen to over USD 10 billion in late 2021, up from just under USD 1 billion in April 2020.

Large reductions in the value of key cryptocurrencies like Bitcoin, Ether, and others were recorded as word of the crypto Bill being lined up for legislation spread, however the development was not particularly tied to its intended tabling during the forthcoming Winter Session of Parliament.

What concerns do people have about cryptocurrency?

PM Narendra Modi remarked in mid-November during a virtual meeting of the Sydney Dialogue — a conference focusing on emerging, critical, and cyber technologies — that all democratic countries must work together to ensure that “it does not end up in the wrong hands, which may corrupt our young.”

Earlier, the PM presided over a discussion on cryptocurrencies, during which it was underlined that unregulated crypto markets might be exploited for money laundering and terror funding, as well as worries about false claims of big returns on cryptocurrency investments.

According to sources, the practise of enticing investors, particularly youths, with marketing that over-promised profits while concealing hazards was discussed during the conference.

What is India’s official position on cryptocurrencies?

According to reports, the cryptocurrency Bill was not introduced in Parliament during this year’s Budget and Monsoon sessions, despite the fact that Union Finance Minister Nirmala Sitharaman stated in July that the wait was only to see “when the Cabinet can take it up and consider it so that we can move it.” “..

The Bill’s phrasing in the legislative agenda for the Winter session hasn’t changed: it aims to “establish a facilitative environment for… the official digital currency to be issued by the Reserve Bank of India,” as well as “prohibit any private cryptocurrencies in India.” However, the bill allows for “limited exclusions to promote the underlying technology of cryptocurrencies and its applications.” “..

Reports stated during the Budget Session that the Bill would be “one of the world’s strongest rules against cryptocurrencies (and) would criminalise possession, issuing, mining, trading, and transferring crypto-assets,” citing an anonymous government source “.. Investors would be given a window to sell their crypto assets if this happened, according to the report, after which penalties would be imposed.

However, the Finance Minister’s statements that the government was “looking at ways in which experimentation might happen in the digital world and cryptocurrencies” were seen positively by investors, according to the same report “.. “I can only offer you this indication,” she said in reports, adding that “a very calibrated position would be made” on bitcoin.

Following its listing for presentation in the Winter Session, security sources stated the government would not opt for a “outright ban” and that regulatory procedures would be put in place to avoid cryptocurrency misuse. However, they stated that cryptocurrencies would not be recognised as legal cash since doing so would jeopardise the country’s fiat currency and taxation structure.

How is cryptocurrency trade possible in India?

The Union finance ministry cited a Reserve Bank of India (RBI) circular from April 2018 that “advised all the entities regulated by it not to deal in” virtual currencies in response to a question in Parliament during the last Budget session on whether there was a ban on “bitcoin trading in the country.” The RBI circular, however, was declared invalid by the Supreme Court in a verdict issued in 2020. As a result, Indian investors have been permitted to participate in bitcoin trading.

Despite the Supreme Court’s decision, numerous private and public banks are said to have continued to discourage their clients from trading in cryptocurrencies, citing the original RBI circular. As a result, the central bank clarified last month that banks cannot use the circular to refuse services for bitcoin transactions.

“In light of the Hon’ble Supreme Court’s ruling, the circular is no longer valid as of the Supreme Court’s judgement date, and so cannot be referred or quoted from,” RBI added.

Why is Indian government frustrated with cryptocurrencies?

Several nations, notably China, which had emerged as a major participant in the cryptocurrency mining field, have outlawed cryptocurrencies. Most countries are concerned that unregulated digital currencies could jeopardise central governments’ ability to create fiat money and oversee monetary policy, even as cryptocurrencies become a conduit for tax evasion and wealth transfer.

“The government does not consider cryptocurrencies legal cash or coin,” the Finance Ministry said in Parliament in August, “and will take all efforts to eradicate usage of these crypto-assets in financing illicit operations or as part of the payment system.”

A high-level inter-ministerial committee set up to look into concerns surrounding virtual currencies had suggested that “all private cryptocurrencies, excluding any cryptocurrency issued by the government, be forbidden in India,” according to the report “.. However, the ministry added that the government “would investigate the application of blockchain technology proactively for ushering in the digital economy.”

The distributed ledger architecture that underpins cryptocurrency offers is known as blockchain. Governments and corporations are said to be looking at its potential to change a variety of industries.