A new week starts with Bitcoin (BTC) near some key moving averages and below $45,000. What will happen next?

Over the past week, Bitcoin has eroded most of its subsequent recovery following a cascade of levered position unwinding that caused the market to plummet to $42,800.

There was little change in paradigm over the weekend, and now downside volatility is firmly entrenched. Traders may be able to predict what the next move will be if they know these five things that are influencing BTC/USD’s decline in a week.

Stocks on the verge of a rebound

After Bitcoin suffered in the first half of September due to selling pressure, stocks are expected to do better this week.

Having just finished a week of red in the stock market, investors now expect stocks to rally, continuing the decline that has marked markets since the Coronavirus crash in March 2020.

According to Charles Edwards, CEO of investment management company Capriole, investors should expect equities to bounce this week and provide some relief for bitcoin.

It has become increasingly questioned over the past year whether Bitcoin is in sync with macro trends. The Federal Reserve Jackson Hole virtual summit, which took place earlier this month, confirmed that shocks to the system continue to affect BTC price action.

“The world still sees Bitcoin as a risk on asset,” Edwards added in comments alongside a comparative chart.

“Almost every Bitcoin correction in 2021 has correlated with a S&P500 correction of -2% or more.”

As a consequence, strong stocks can help restrain the strength of the US dollar, which will also allow Bitcoin to continue to thrive.

Despite a sharp move towards 93, the dollar currency index (DXY) paused to consolidate the gains it made, a process that continues.

Despite bullish indicators, spot price continues to sag

The macro moves could be a critical factor in determining the price trajectory of BTC this week, forecasts argue.

During the weekend, the BTC/USD pair ranged, but yesterday’s volatility saw it slip below $45,000.

The disparity between on-chain metrics, adoption phenomena, and price has never been so great with spot traders hedging their bets on more downside.

“Stablecoin liquidity increasing, bitcoin on exchanges hit a 3-year low, normies awaken,” Moskovski Capital CEO Lex Moskovski summarized.

“If macro doesn’t shit the bed, the next leg up is programmed.”

According to Moskovski, macro markets did indeed start the week on the positive side, and stablecoins, not being used as collateral for short sales, were clearly bullish.

According to current estimates, $43,000 and $38,000 represent potential price floors, although they are well below important moving averages.

Accordingly, price predictions predict that Bitcoin’s “real” upside will begin in October, despite September’s historically poor performance.

Popular Twitter account Lark Davis replied to followers Monday that monthly volatility in bitcoin often occurs in September and Q4.

“BTC can still hit 100k by end of year.”

Peter Brandt, a veteran trader, is still sounding the alarm at least for the time being.

“There is a name for this chart pattern. Anybody want to take a guess what it’s called?” he tweeted alongside the daily chart showing what appears to be a breakdown of a bearish pennant construction.

“Dancing with 2017”

When it comes to this halving cycle, Bitcoin is still performing better than 2017 when it comes to price gains.

The data comes from Decentrader, which this week reported that BTC/USD is still on track for 2021 following the halving of block subsidies.

“Dancing with 2017 at the moment,” Decentrader analyst Filbfilb stated over the weekend.

In this graph, you can see how the May miner strike affected progress. In 2013, bitcoin experienced gains, but during May 2017, it took a dip, creating a lower paradigm that continues to exist today.

According to reporters, analysts are predicting a “double top” for the end of 2021 — just as in 2013 and 2017 — followed by a price fall in line with the peak of May 2019.

Monthly illiquid supply reaches a new high

Investor behavior during last week’s price drop is what set it apart from previous dips – everyone bought on the drop.

It was the opposite of March 2020 when speculators flooded the market with excess inventory, which strong buyers eagerly snapped up.

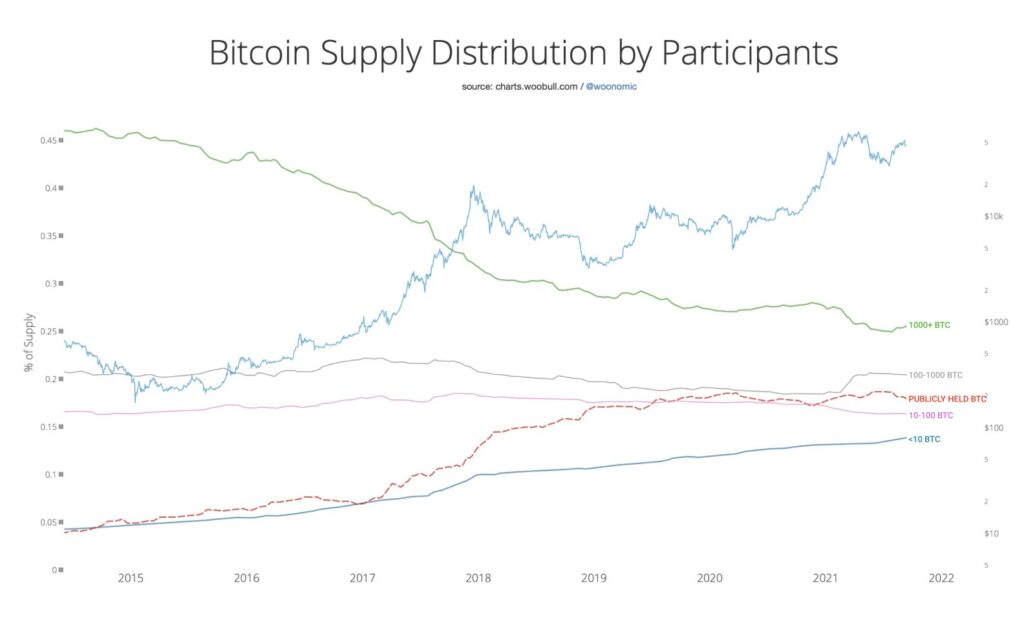

Willy Woo, a statistician, says all classes of Bitcoin investors have either stayed neutral or added to their positions during the recent volatility.

“Whales added recently. Minnows continue to stack. 10-1000 BTC holders mainly flat,” he revealed Sunday alongside data from on-chain analytics firm Glassnode.

“Reserves held publicly reducing (mainly exchanges and ETFs reducing while corporates adding).”

Similar data reinforces the idea that Bitcoin’s supply is becoming more scarce than ever. The hodler patterns did not change significantly last week, according to William Clemente.

“93% of Bitcoin’s supply hasn’t moved in at least a month. This is an all-time high. Just another metric showing how bullish supply dynamics are,” he commented, citing Glassnode data.

Fear has replaced greed in the past.

There’s a big change afoot for investor sentiment gauge, the Crypto Fear and Greed Index, which is reporting some interesting data this week.

By dropping to $42,800, it shifted from “extreme greed” to “fear,” which persisted all the way through Sunday.

Despite the falling prices this weekend, the Index added some “greed” to the mix as the weekend ended.

As of Monday morning, Fear & Greed stood at 44/100. The RSI remains in “fear” territory. Bitcoin is currently trading below $45,000.

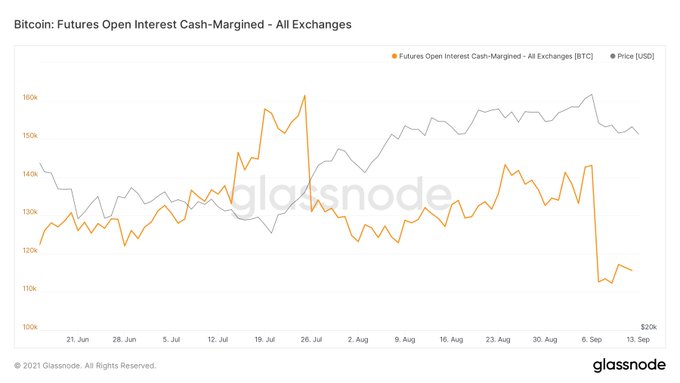

While funding rates are slightly positive across exchanges, one cannot discount the possibility of a “short squeeze” boosting price performance.